How to Trade using Point and Figure Chart?

What is a Point and Figure Chart?

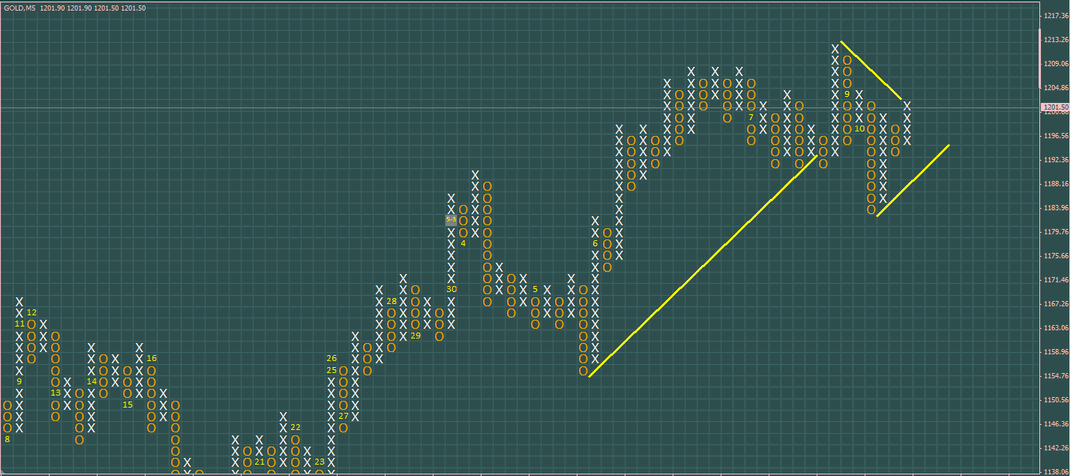

In point-and-figure charts, time isn't an issue since prices are plotted without regard to how long they've been moving.

A P&F chart measures price changes by plotting a sequence of stacked X's or O's, which together indicate a fixed amount of price change. These O's show the decreasing price as increasing prices rise.

Despite new ideas like support and resistance being introduced, technical analysts still rely on notions such as assistance and resistance, as much as other trends, when they look at P&F charts. Other others believe that support and resistance levels, along with breakout zones, are easier to see on a P&F chart, since the little price fluctuations have been removed and the charts are less likely to be tricked by false breakouts.

Leverage the best UK forex traders and get support and resistance on your trading investments.

How to Calculate Point and Figure Charts?

The good thing about point-and-figure maps is that they don't need calculations to be made, but they do involve two variables to be specified.

There is just one variable—the size of the box. A particular cash amount (such as $1), a percentage (such as 3 percent), or calculated on ATR (average true scope) would all result in a fixed size box.

You will also need to provide the reversal value. The average box is three times as large as the reverse amount. The following shows two different examples of calculating the turnaround amount: Box size: $1 Flip amount: $3 Setting the reversal in any way that the trader wants is possible, including, for example, a 1:1 (1 times the size of the box), or 5.5:1 (5.5 times the size of the box).

You have the choice of using the closing price or the higher or lower pricing on the basic value. Closure prices imply less X's and O's are produced while utilizing just rising and falling prices mean more X's and O's are generated.

Earn good profits with the world’s best forex broker in the USA and achieve your goals.

What does a Point and Figure Chart Tell You?

While candlestick charts offer technical analysts with distinct trade and trend signals, compared to conventional point-and-figure charts, point-and-figure charts sometimes provide technical analysts with differing trade and trend indications, as opposed to classic candlestick or bar charts. Some experts use point-and-figure charts to help verify breaking-out indications offered by conventional charts, while many use these graphs to validate signals given by conventional charts to prevent misleading breakouts.

The box size, or the amount of price change that decides whether a new X or O is added to the chart, is crucial to point-and-figure charting. For example, consider the size of the box: $3. A new X is added to the current column whenever the previous X's price increases to $18.

Due to the above requirements, the line of X's will stay to run down the column if the value keeps going up but will change column if the price is above a predefined break-even value, at which time a new column of O's will be established.

As in a falling market, when a stock's price declines to the reversal level, another column of O's is created.

The price isn't increasing fast sufficient to add another X or O to the existing X or O line, and then it increases three box sizes. Reversals will generate multiple Xs or Os to be drawn simultaneously. This simple example illustrates two scenarios: when there is a price increase or a column of X's, but when the price rises and an X appears; if the price rises, a reversal will happen and will consist of three box sizes. When the turnaround happens, three O's will initiate at one position underneath the highest X.

Like most other charts, P&F charts are used by traders in techniques identical to each other. Traders look for support and resistance areas, regardless of the method. Breakouts may signify a significant shift in the current trend. When the box shifts (from O to X, or X to O), the column may indicate a major trend reversal or retreat.

Point and Figure Analysts

To identify supply and demand imbalances in the financial markets, Charles Dow, The Wall Street Journal's creator, invented point-and-figure charting.

Tom Dorsey, the founder of Dorsey, Wright & Associates, is a renowned technical analyst who specializes in point-and-figure graphing. For predicting and monitoring market prices, Point & Figure Charting: The Essential Application is a must-have book written by him. In 2015, NASDAQ bought Dorsey, Wright & Associates. 2

Leveraging more conventional technical indicators, like rolling averages, overall strength, and progress lines, Dorsey assisted to popularise the usage of point-and-figure graphs.

Earn profits with the top 10 forex trading platforms to figure out a way to trade with graphs.

The Difference Between Point and Figures and Renko Charts

Once the value changes by the box size, Renko Charts construct a 45-degree up or descends brick that travels together with the previous brick. Bricks never appear adjacent to each other on Renko charts. This, therefore, leads to a change in momentum if the price changes by two box values in the other way.

To put it simply, the chart kinds are all different because of their appearance. On P&F charts, a set of boxes spanning across time at 45-degree inclinations make up a chart.

Limitations of Using Point and Figures Chart

It may take P&F charts a while to respond to price fluctuations. In order to indicate a breakout happened, a breakout must shift the box amount. False breakout alerts are reduced with this implementation, but the value has indeed gone beyond the specified boundary in either direction. It may not be beneficial for some traders to wait for a significant price movement after they've received the signal.

In addition, although P&F charts may assist prevent false breakouts, false breakouts do occur. The breakout may not be real but may be short-lived.

When used correctly, P&F charts assist traders in holding on to big trends due to the fact that a large number of minor counter-trend movements are eliminated. Yet when a reversal happens, gains or losses may be substantially erased. Because reversal amounts are sometimes very big, a trader must be utilizing P&F charts in order to notice a reversal earlier.

It is essential to additionally track the value of the asset while utilizing P&F charts to ensure risk is being managed in real-time. You may monitor a candlestick or OHLC chart to do this.

Choose the right forex broker from our forex reviews guide to read the point and figure charts.