US Regulators Have Imposed $2.5 Billion Penalties on Crypto Firms and Individuals.

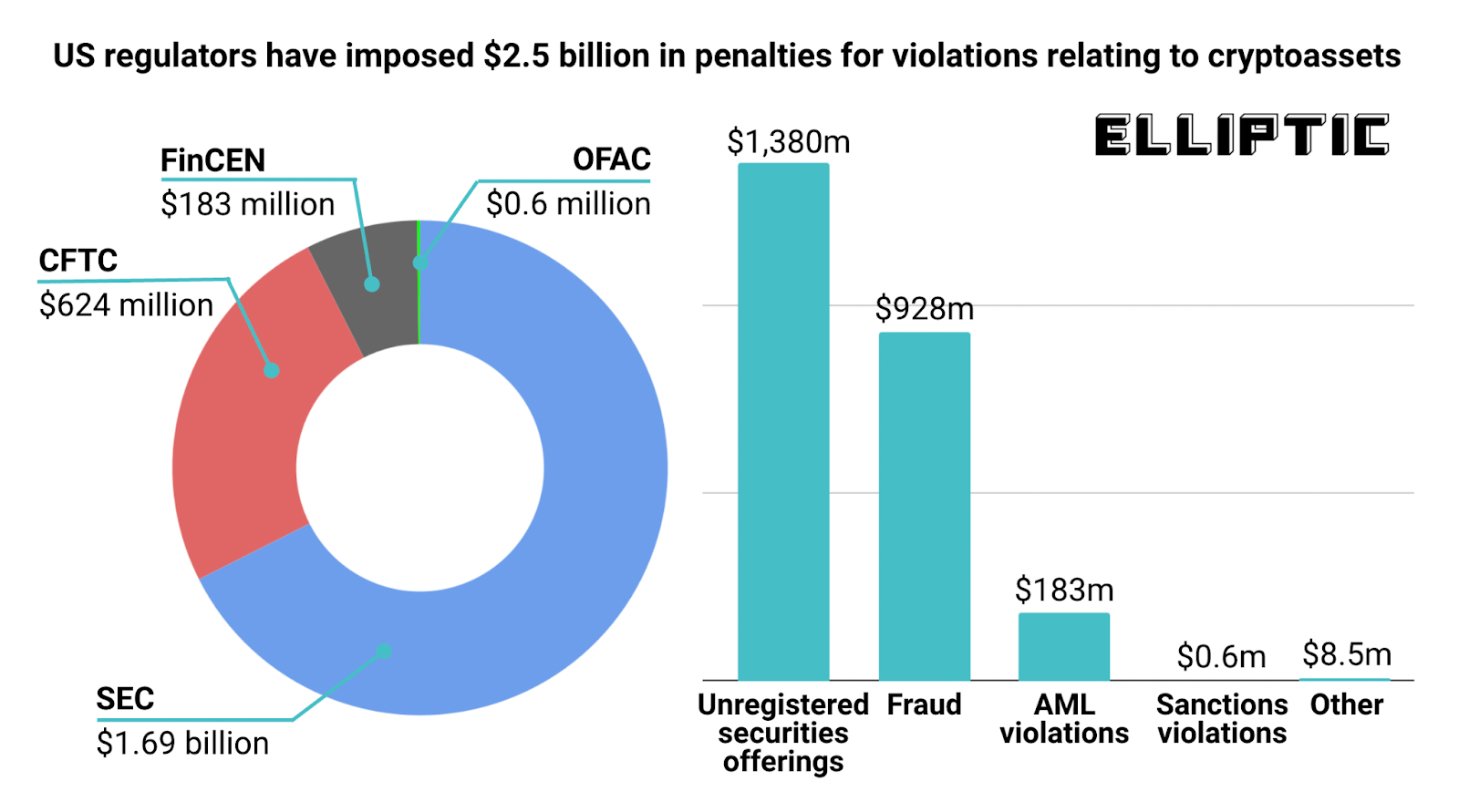

As per a new report, US regulators have imposed fines and penalties totaling $2.5 billion on crypto firms and individuals thus far. The Securities and Exchange Commission (SEC) in the United States has imposed the most fines, followed by the Commodity Futures Trading Commission (CFTC). Meanwhile, the Office of Foreign Assets Control (OFAC) of the United States Treasury is the latest government agency to target cryptocurrency firms.

$2.5 Billion in Fines and Penalties

Elliptic, a blockchain analytics company, published a report on Monday detailing “crypto enforcement efforts by US regulators.” “Contrary to popular assumption, the cryptoasset market is unregulated in the United States, US regulators are increasingly imposing major financial penalties on crypto companies — for fraud, AML violations, offering unregistered securities, and sanctions violations,” according to the research.

Since the inception of Bitcoin in 2009, Elliptic has reviewed enforcement actions by US regulators and discovered that “$2.5 billion in penalties have been imposed against organisations and individuals dealing in crypto,” according to the research.

The Securities and Exchange Commission of the United States is the agency that has imposed the most crypto-related penalties (SEC). So far, the SEC has required crypto companies and individuals to pay $1.69 billion, with $1.38 billion of that relating to unregistered security offerings.

The Commodity Futures Trading Commission (CFTC) came in second with $624 million in enforcement actions. With $183 million, the Financial Crimes Enforcement Network (FinCEN), a division of the US Treasury Department, comes in third.

The Office of Foreign Assets Control (OFAC) of the United States Treasury is the fourth federal body to take action against cryptocurrency companies. The US Treasury Department's Office of Foreign Assets Control (OFAC) has levied a total of $606K in sanctions against crypto companies. Bitgo and Bitpay were among the companies punished by the OFAC; both were accused of allowing its users to circumvent US restrictions.

The largest enforcement action to date was taken against Telegram Group Inc. & its wholly owned subsidiary Ton Issuer Inc. in 2020, the report notes. The Securities and Exchange Commission (SEC) claimed that Telegram's "grammes" tokens were an unregistered securities offering. The defendants agreed to pay $18.5 million in civil penalties and repay more than $1.2 billion to investors.

The report concludes with the following:

Our examination of cryptoasset-related enforcement proceedings in the United States shows that crypto is far from being the financial "wild west." Regulators have used existing rules to successfully prohibit and penalise unlawful conduct with cryptoassets.